- +91 9723429890

-

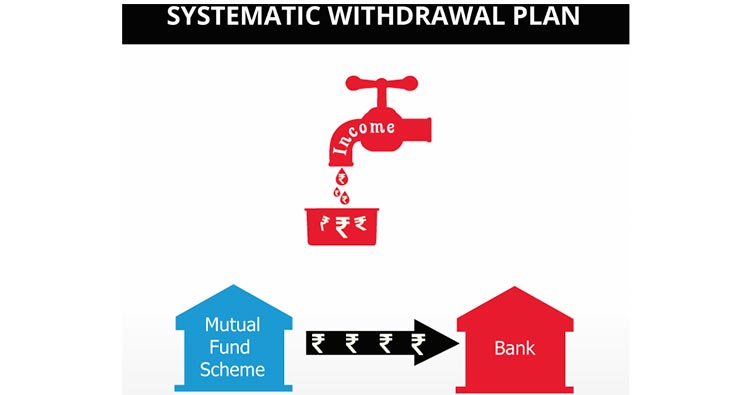

SWP or systematic withdrawal plan is a mutual fund investment plan, through which investors can withdraw fixed amounts at regular intervals, for example – monthly/ quarterly/ yearly from the investment they have made in any mutual fund scheme.

The investors can choose a day of the month/quarter/year when withdrawal can be made and the amount credited to investors bank account by the AMC. To generate this cash flow, SWP Plan redeems units of mutual fund scheme at the chosen interval. Investors can continue with SWP as long as there are balance units in the scheme.

Example - Investor invests lump sum Rs 20.00 lakhs in a mutual fund scheme. The purchase NAV is Rs 20; therefore, 1,00,000 units are allotted. Let us assume investor started a monthly SWP of Rs 12,000 after one year from the investment date, just to avoid exit loads.

In the 1st month of SWP, let us assume the scheme NAV was Rs 22. In order to generate Rs 12,000, the AMC redeems 545.456 units (Rs 12,000 / 22 NAV), therefore, the balance units will now be 99,454.544(1,00,000 minus 545.456). In the 2nd month, assuming NAV was 22.50, the AMC redeems 533.333 units (Rs 12,000 / 22.50 NAV), therefore, the unit balance reduces to 98,921.211 (99,454.544 minus 533.333). In the 3rd month, assuming the NAV was 23.00, the AMC redeems 521.7392 units (Rs 12,000 / 23.00 NAV) and now the unit balance reduces to 98,399.4718. This process continues every month till the end of the SWP period chosen by the investor.

As seen in the above example, unit balance reduces over time in SWP plan, but if the scheme NAV appreciates at a percentage higher than the withdrawal rate, the investment value appreciates. However, if the scheme NAV falls instead of rising, then effect on your investment value will be opposite. This is because withdrawals in scenario where NAV is falling will require more number of units to be redeemed.

1) Flexibility:

In a SWP plan, investor has the flexibility to choose the amount, frequency and the date according to his/her needs. Also, the investor can stop the SWP at any point in time / or can add further investments or even withdraw amount over and above the fixed SWP withdrawal.

2) Regular Income:

SWP in mutual funds facilitates investors by providing a regular income from their investments. Therefore, this becomes highly convenient and useful for those who need regular cash flow for meeting regular expenses.

3) Capital Appreciation:

If the SWP withdrawal rate is lower than the fund return, the investor gets some capital appreciation too in the long term. See below table :

|

Investment Amount |

3000000 |

||

|

Monthly SWP |

15000 |

||

|

Time Period in Years |

10 |

||

|

Expected Return |

10% |

11% |

12% |

|

End Value of Portfolio after 10 years |

48,000,00 |

53,000,00 |

59,000,00 |

This is for illustration purpose only.

4) No TDS:

For resident individual investors, there is no TDS on the SWP amount.

1) For those looking for regular source of secondary income:

The investor who knows what is SWP plan, they know very well that it can be a source of creating an additional income stream from their long-term investments. It can help tide over the rising living cost. Therefore, investing for the long term in mutual funds and withdrawing regularly through SWP may be an easy way to create a regular source of secondary income.

2) Those wanting to create their own pension:

Investors who do not have any pension earnings can create their own pension by investing the retirement corpus in schemes suiting their risk profile and earn a regular income at a frequency chosen by them. Therefore, on retirement, the investor can start an SWP and create their own pension.

3) Those who are in high tax bracket:

Investors in high tax bracket find SWP useful as there is no TDS on the capital gains. Also, the capital gains from equity/equity-oriented funds are taxed moderately. Gain from debt-oriented funds is also moderate as indexation is allowed on the long-term capital gains.

In summary, if investor can analyse what is systematic withdrawal plan in mutual fund, they will find that SWP is a good strategy to have a regular income with some sort of regularity. The good part is that the returns are tax efficient and there is no TDS on gains unlike traditional investment options.

Disclaimer: Mutual fund investments are subject to market risk please read all scheme related documents carefully before investing.

Tags : ,

+91 97234 29890

+91 87358 32244

247/Fortune Landmark

Opp - Vishal Mega Mart

Near - VIA Ground

Vapi -396191

Copyright © Nirvi Investments 2021. All rights reserved.